When it comes to choosing the best investment plans in India, there are many options. The trick is to figure out which one suits your needs the best. A smart way to do this is by dividing your financial goals into three categories: long-term, medium-term, and short-term. This helps you decide how much time you have to reach each goal and choose your investments accordingly.

Let’s break down some of the best investment options in India based on these categories.

Suggested Read: Integrate Real-Time and Historical Stock Market Data API with PHP

What is an Investment Plan?

An investment plan is like a roadmap for your finances. It helps you decide why, where, and how much to invest to reach your financial goals, such as buying a house, saving for your kids’ education, or planning for retirement. India offers various investment options like stocks, mutual funds, fixed deposits, and bonds. The goal is to choose one that fits your needs and risk tolerance. Remember, investment planning is not a one-time thing; it needs regular reviews and adjustments.

Types of Investment Options in India

Investment options can be divided into three categories based on risk and returns:

1. Low-risk investments

These involve minimal risk and offer stable returns, such as Fixed Deposits, Public Provident Fund (PPF), and Sukanya Samriddhi Yojana.

2. Medium-risk investments

These involve moderate risk and aim for decent returns, like Debt Funds, Corporate Bonds, and Government Bonds.

3. High-risk investments

These are more volatile and seek higher returns, suitable for those willing to take more risk, like stocks and mutual funds.

Best Investment Options for Long-Term Goals

Long-term goals are usually 7-10 years away. These options can be more volatile but have the potential to offer high returns:

1. Direct Equity

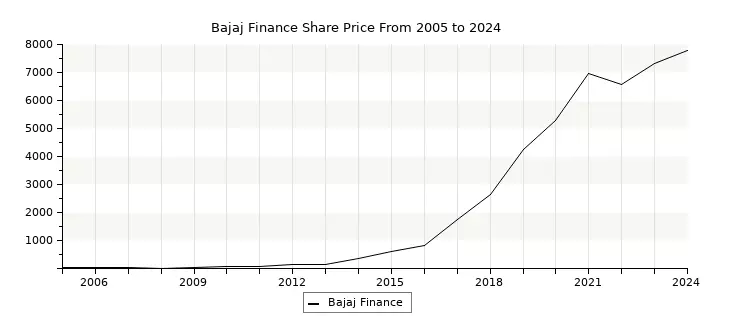

Investing in stocks can create significant wealth over time. For example, Bajaj Finance has given over 44.1% returns annually over the past 15 years. You need a demat account to invest in stocks. There’s no minimum or maximum investment limit, and you can sell your shares anytime.

Image Source: ETmoney

2. Equity Mutual Funds

These funds invest in a variety of stocks and are managed by professionals. You can start investing with as little as Rs 100. There’s no lock-in period, except for Equity Linked Saving Schemes (ELSS) which have a three-year lock-in period.

3. National Pension System (NPS)

A retirement-focused investment that mixes assets like stocks, government, and corporate bonds. You need to invest at least Rs 1,000 per year. When you retire, you can withdraw 60% of the corpus tax-free.

4. Unit Linked Insurance Plans (ULIPs)

These offer both insurance and investment. Part of your premium goes into equities and bonds. Investments up to Rs 1.5 lakh are tax-deductible under Section 80C.

5. Real Estate

Buying property can provide substantial returns through appreciation and rental income. However, it comes with risks like illiquidity (difficulty in selling).

6. Public Provident Fund (PPF)

A government-backed savings scheme with a 15-year maturity period. It offers tax benefits, and the returns are tax-free.

Best Investment Options for Medium-Term Goals

Medium-term goals are usually 3-5 years away. These options offer decent returns with moderate risk:

1. National Savings Certificates (NSC)

A post office savings product with a five-year maturity period offering guaranteed returns. You can claim tax deductions under Section 80C.

2. Post Office Time Deposit

Similar to bank fixed deposits but with potentially better returns. The five-year deposit is eligible for tax deduction under Section 80C.

3. Debt Funds

These funds invest in bonds and other debt securities. They are less volatile than equity funds and have no lock-in period.

4. Hybrid Funds

These invest in both stocks and bonds, offering a mix of growth and stability.

Best Investment Options for Short-Term Goals

Short-term goals are usually 1-3 years away. Here, the focus is on minimizing risk and ensuring liquidity:

- Bank Fixed Deposits (FDs): These offer guaranteed returns and come with varying maturity periods, from seven days to ten years. The interest earned is taxable.

Conclusion

Choosing the best investment plan involves understanding your goals, risk tolerance, and the time you have to achieve those goals. By categorizing your goals into long-term, medium-term, and short-term, you can select the most suitable investment options and create a diversified portfolio that aligns with your financial objectives.

Disclaimer

Investing in the stock market involves risks, including the loss of principal. The value of investments can go up as well as down, and past performance is not indicative of future results. It is important to conduct your own research and consider your financial goals, risk tolerance, and investment horizon before making any investment decisions.

Aman Kumar is the Financial Expert and Advisor. He has been a worked over 10+ years, covering mutual funds, insurance, banking, real estate, taxation and financial planning. He is not a SEBI Registered Financial Advisor.

[…] Suggested Read: Top Investment Strategies for 2024-25: Maximize Your Returns […]

[…] Also Read: Top Investment Strategies for 2024-25: Maximize Your Returns […]

[…] Also Read: Top Investment Strategies for 2024-25: Maximize Your Returns […]